NJ Spotlight News

Reactions to revised plan to cut property taxes for seniors

Clip: 6/20/2023 | 4m 58sVideo has Closed Captions

Property-tax cuts would go into effect in 2026

Assembly Speaker Craig Coughlin’s "StayNJ" plan initially proposed a 50% credit on property taxes for all seniors. But after critics — including Gov. Phil Murphy — called it a benefit for even the richest homeowners, Trenton’s top three Democratic lawmakers reached a compromise to cap the tax credit at $6,500 instead of $10,000 for homeowners age 65 and over who earn $500,000 or less.

Problems with Closed Captions? Closed Captioning Feedback

Problems with Closed Captions? Closed Captioning Feedback

NJ Spotlight News is a local public television program presented by THIRTEEN PBS

NJ Spotlight News

Reactions to revised plan to cut property taxes for seniors

Clip: 6/20/2023 | 4m 58sVideo has Closed Captions

Assembly Speaker Craig Coughlin’s "StayNJ" plan initially proposed a 50% credit on property taxes for all seniors. But after critics — including Gov. Phil Murphy — called it a benefit for even the richest homeowners, Trenton’s top three Democratic lawmakers reached a compromise to cap the tax credit at $6,500 instead of $10,000 for homeowners age 65 and over who earn $500,000 or less.

Problems with Closed Captions? Closed Captioning Feedback

How to Watch NJ Spotlight News

NJ Spotlight News is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipNew Jersey's seniors are poised for a big property tax cut Governor Murphy and Democratic leaders in the legislature have tentatively agreed on a revised tax relief program despite mounting criticism the deal is a compromise on the stay NJ proposal that recently became a sticking point in state budget negotiations briefly threatening to cause a government shutdown it'll effectively cut property taxes in half for older residents making less than half a million dollars a year the rub the full cost is still unknown and if approved eligible residents wouldn't see the money for at least another three years a senior correspondent Brenda Flanagan reports opponents argue even this new version of the program benefits the wealthy at the expense of lower income seniors we think it'll really change the equation for many as they're sitting at that kitchen table and thinking about can they afford to stay here some Advocates applauded the latest compromise plan from Democrats to cut property taxes in half for seniors in New Jersey even though it's a reduced benefit with an income cap stay in J still aims to Shield folks on fixed incomes from onerous bills that would force them from their homes and even though it won't kick in until 2026 the revised measure now includes renters says aarp's Evelyn Liebman and with an income cap more resources could be directed to our renters initially speaker Craig Coughlin stay in J plan simply offered a 50 credit on property taxes for all seniors but after critics including Governor Murphy called it a benefit for even the richest homeowners Trenton's top three Democratic lawmakers reached this compromise for stay NJ the 50 tax credits now capped at 6 500 dollars instead of ten thousand for homeowners age 65 and over who must earn a half million dollars or less it also includes a tax credit for renters not just homeowners for Democrats on the hustings it's sweet campaign candy but not everyone's running for reelection and I do question if you know someone who is making half a million dollars a year really needs help from the state to pay their property taxes assemblywoman Sadaf Jaffer who isn't on the November ballot continues to voice concerns she says State NJ fails to help the folks who need it most even though this latest compromise would also add another 250 dollars in the next budget to the current anchor rebate program for homeowners and renters so you know again to me it all goes back to the issue of equity what will this provide for the over 50 percent of Black and Hispanic seniors who rent their homes versus live in owner occupied residences it's definitely less regressive than the original proposal but it still has the same fundamental flaws as the original proposal an NJ policy perspectives Peter Chen as budget analysts keep revising state revenue estimates downwards when the bill for stay NJ comes due in three years could New Jersey afford to pay it I don't know if that's the best way for the state to spend its money when we're we're not you know when we're facing some serious fiscal cliffs NJ Transit is about to face a 900 million budget deficit is this how we want to be spending the money I mean it's pretty obvious that this is um what they want voters to remember writers Micah Rasmussen sees a well-worn New Jersey political tactic that's Brazen but very effective as all 120 legislative seats go on the ballot in a low turnout election that's got some Democrats chewing their nails you're not just saying you're getting a credit you're saying we're cutting your property taxes in half that's a powerful rhetorical talking point that's a pretty strong answer and so I expect it to have an impact this is nothing more than an election year gimmick in an effort to try to you know essentially purchase votes and we all know the money might not be able to be there in three years Republicans have their own plan to immediately return some of New Jersey's current Revenue bonus to taxpayers why not do something that's going to give immediate relief we have a 10 billion dollar Surplus p people can get relief immediately why are we delaying it into until 2026. with Democrats holding a Trenton Trifecta the gop's plan is DOA meanwhile there's no official cost estimate yet for stay NJ but if it passes will it get full funding when the full current Revenue Surplus as many predict runs woefully short I'm Brenda Flanagan NJ Spotlight news [Music] [Music]

Black residents use new methods to trace ancestry

Video has Closed Captions

Clip: 6/20/2023 | 4m 10s | DNA analysis is being used to guide people to their roots (4m 10s)

In-person gambling revenue declined again in May

Video has Closed Captions

Clip: 6/20/2023 | 1m 25s | But total revenue, from online and in-person gambling, was up 9% compared to May 2022 (1m 25s)

Push to give free school lunches to all students in NJ

Video has Closed Captions

Clip: 6/20/2023 | 4m 44s | Interview: Lisa Pitz, director of Hunger Free New Jersey (4m 44s)

What does prospect of longer-term budget gaps mean for NJ?

Video has Closed Captions

Clip: 6/20/2023 | 4m 18s | State’s current tax and spending policies go under the microscope (4m 18s)

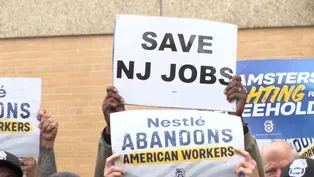

Workers rally over threat of Nestlé plant closure

Video has Closed Captions

Clip: 6/20/2023 | 4m 9s | Closure would mean the loss of 200 union jobs (4m 9s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipSupport for PBS provided by:

NJ Spotlight News is a local public television program presented by THIRTEEN PBS